Revenue Timeline

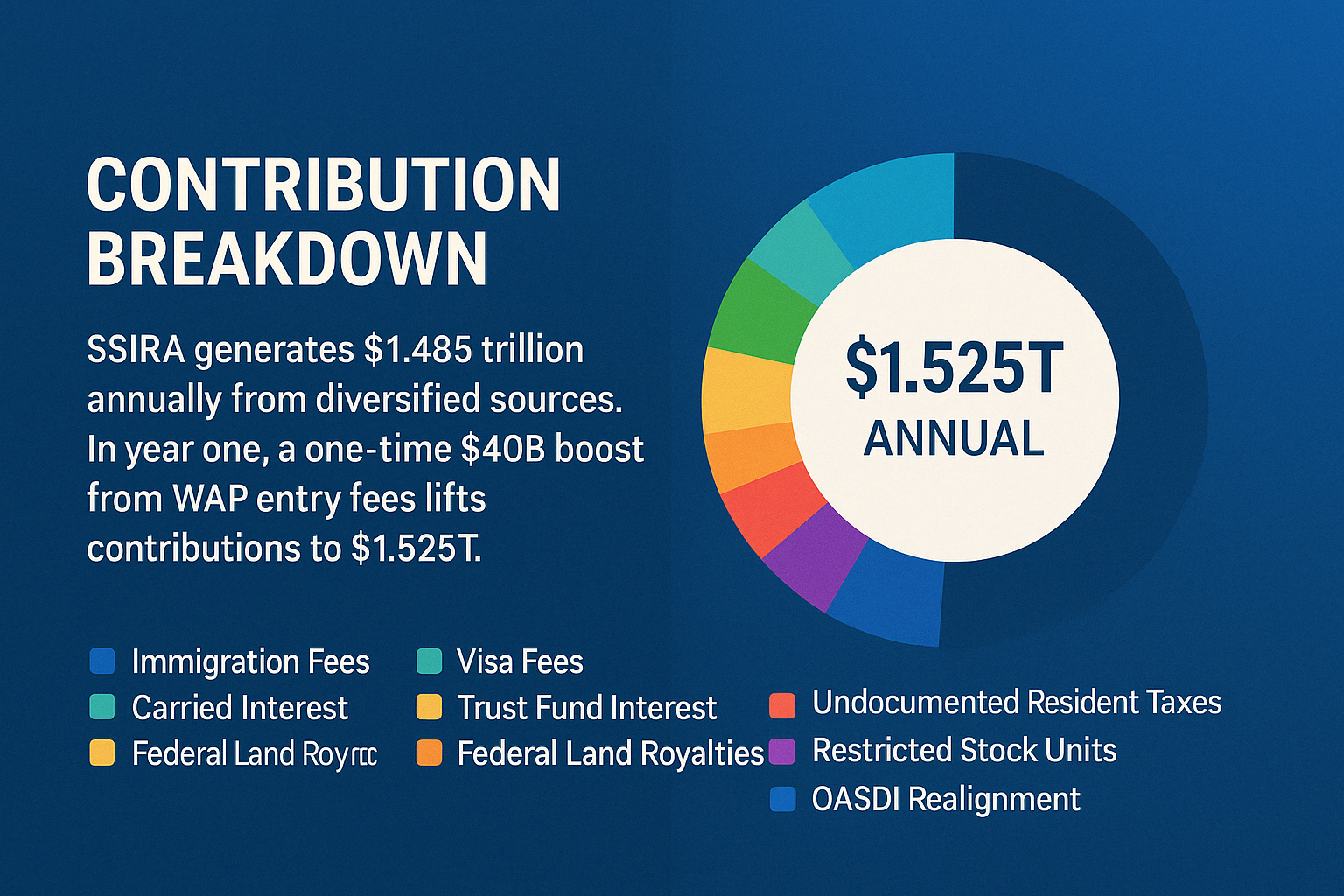

Initial Phase: $1–1.5T per year (2026–2040s)

Later Phase: $500B–1T per year (2050s+)

Principal Growth

SSIF is projected to grow from an initial seed of $1.3T to:

$20.5T by 2037 → $50T by 2040s → $90–110T by 2050s

at an average return of 7–8% annually.

Disbursements

SSIF pays out benefits and health insurance entirely from fund returns:

• 2037: $1.44T benefits

• 2055: $3.34T benefits + $400–600B health insurance